8.2 percent more printed books sold last year – several new softcover lines installed or sold by Muller Martini in 2020 and 2021: the book market in North America is showing pleasing growth despite (or because of) the corona pandemic.

Without exaggerating, the current positive trend can be described as a revival of the North American book market – and not only in softcover but also in hardcover. So, as a participant at the virtual spring conference of the

Book Manufacturers Institute (BMI), which describes itself as the only graphic arts industry association in the US focused on the book manufacturing market, I saw some interesting statistics to support this trend.

23 percent more books in the first quarter of 2021

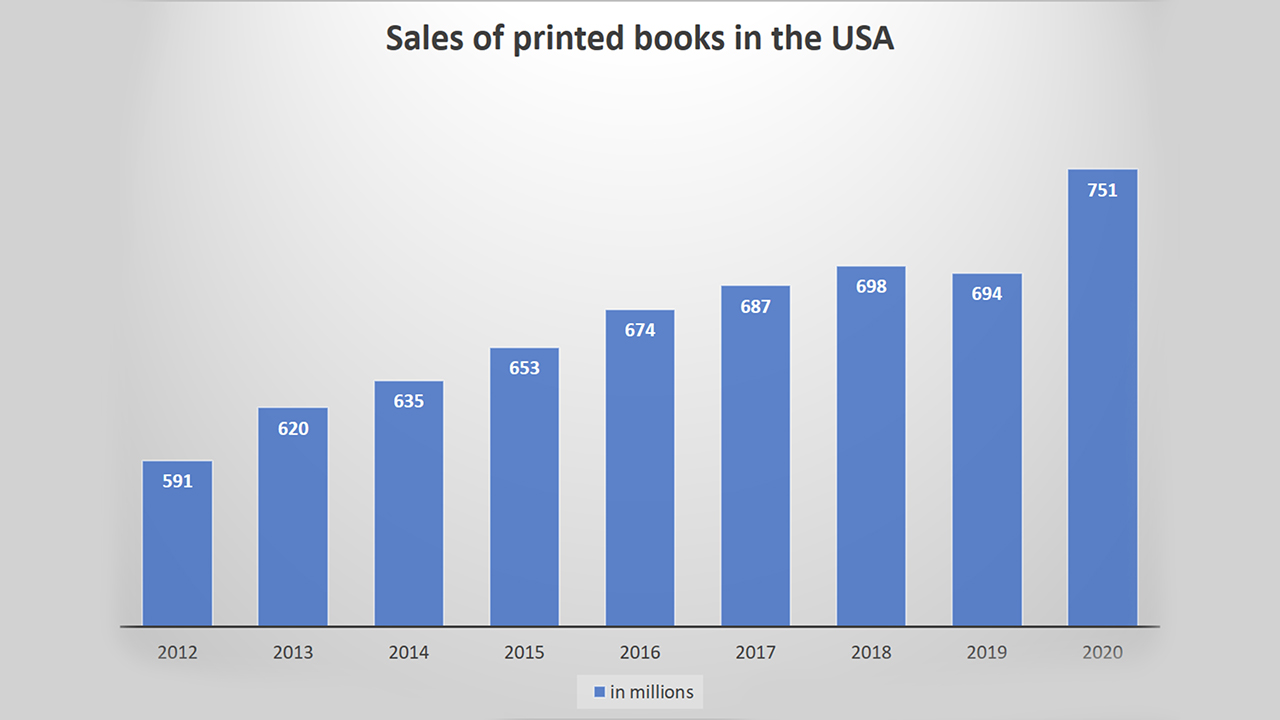

A chart entitled "US unit sales of printed books" from

NPD BookScan, which covers 85 percent of book sales in the US, showed that the number of printed books sold in the US increased from about 694 million in 2019 to about 750 million in 2020. This represents a growth rate of 8.2 percent – and this during the pandemic!

While I have yet to see any new sales figures regarding the volume of books produced in the current year, the other day I learned from a book manufacturer that he produced 23 percent more books in the first quarter of 2021 as compared to the previous year. Another book manufacturer instructed its plants to do their maintenance work now to prepare for future volume demands. These are undoubtedly signs of strength for the North American book market.

E-books stagnate

E-books stagnate

The fact that during the corona pandemic many North American book printers experienced, and are still experiencing, striking growth in the production of books is primarily for three reasons. First, we are seeing a general flight back to reading printed books. Secondly, the younger generation is reading more again, which has led to an upswing in books for young people and bodes well for the book market in the long term. Thirdly, volumes in the book-on-demand segment in particular have also strongly increased.

The fact that more North Americans are buying printed books again also has to do with the fact that they are not being displaced by e-books. A recent report by NPD BookScan, for example, states that the share of e-books in total book publications has levelled off at 20 percent and has not recently increased. This is another reason why publishers are expecting more printed books in the coming autumn season and are asking book manufacturers for higher production capacities.

Both offset and digital printing capacities in demand

The biggest growth sectors for softcover production are in black-and-white trade books and digital book production. As a result, many manufacturers are looking for ways to modify their equipment to bring the production of digitally printed books up to date. As digital production becomes increasingly important, many publishers are insisting that their print partners have both offset and digital printing capabilities so that they can meet their production needs from a single source. That is why digital-only printers are now getting into offset – either through acquisitions or by investing in new equipment. And vice versa, offset printers are expanding their digital capabilities.

Part of the increased volume is also the result of book production moving back to North America and there are several financial and political reasons for this. For example, some religious publishers now prefer production in the home market again. Four-color hardcover books (cookbooks, for example) are also moving back to North America. However, there is still a cost saving of around 40 percent for production in China, so local publishers have to pay more if they move production back to North America.

Several new Muller Martini perfect binders in 2020 and 2021

This positive development also has a pleasing impact on the number of newly installed Muller Martini systems in North America. In 2020 and 2021, we pleasingly installed or sold several perfect binding lines – a colorful mix between our popular Pantera, Alegro, Bolero, KM 610 and KM 412 products. While these orders did not come from any completely new customers, some of them had never purchased a new machine from us before. This increased interest in buying new equipment with the latest technology, and therefore with a higher level of investment, shows our customers' confidence in the strength of the North American book market.

Most of these recent orders have been either to replace older, obsolete machines or to purchase a machine to increase capacity due to growing book production demands. One exception was a traditional digital book manufacturer who purchased a new Alegro line to add offset finishing features to their operation. This supports my point above that publishers insist that their print partners have both offset and digital systems under one roof.

From secondhand to new equipment

One project was particularly interesting from a sales process perspective. One of the Alegro orders that we received this past March started as a project that we thought would be very difficult to complete. Our Service Department was initially called to this customer to help them maintain a second-hand Bolero line that the customer bought on the second-hand market and installed in early 2020. After trying to help them with several service calls, they ultimately realized that the line might never run properly.

So the customer asked us to come over and talk about a new perfect binder. They made it clear to us that they had spent a considerable amount of money on the used Bolero and that the amount of investment for this project was limited. Nevertheless, we persistently promoted all the advantages of a new Alegro line and, more importantly, the benefits of buying directly from Muller Martini. In the end, the customer realized that buying the new perfect binder line was the best way forward for them to create stability and security for their book manufacturing growth initiatives. Let's call it a win for "your strong partner"!

The Alegro is particularly popular

Keyword

Alegro: half of the perfect binders installed or sold (and soon to be installed) in the past two years and all four major softcover sales in the current year were of this type. The main reasons the Alegro is so popular are due to its high degree of automation and modularity. Some customers also liked its future scalability – i.e. they can add digital book production functions to the Alegro with our module for accurate book block feeding, while others appreciated the end-to-end system automation integrated into the overall line.

In addition to the obvious benefits of our market-leading technology, the comprehensive sales, service and spare parts support provided by our North American operation also makes the decision in favor of Muller Martini an easy one for many customers.

We together with our customers certainly look forward to continued growth in this important segment of our business.

Your

Andy Fetherman,

Vice President of Sales and Technology, Muller Martini North America